The short answer is Yes. According to both local and federal courts, what you say during a butt-dial phone call can potentially be used against you in court. In Texas, a hearsay exception makes those overheard statements admissible. In the federal system, these calls are viewed as having no reasonable expectation of privacy—since you did not take simple precautions to avoid this kind of situation, you cannot expect someone on the receiving end of the call not to repeat what they heard.

The short answer is Yes. According to both local and federal courts, what you say during a butt-dial phone call can potentially be used against you in court. In Texas, a hearsay exception makes those overheard statements admissible. In the federal system, these calls are viewed as having no reasonable expectation of privacy—since you did not take simple precautions to avoid this kind of situation, you cannot expect someone on the receiving end of the call not to repeat what they heard.

Butt-Dials in Texas: Can Words Overheard During an Unintended Phone Call be Used Against Me?

Under Texas law, statements made during an accidental butt-dial are likely admissible and the speaker likely has no reasonable expectation of privacy in those statements. Typically, repeating something in court that you heard someone else say outside of court is not allowed—it is referred to as hearsay and is considered inadmissible in a court of law. But, as with everything, there are hearsay exceptions that, in certain circumstances, allow someone to testify about something they heard someone else say. So, it should not be too surprising that a recent case found that butt-dials fall into one of the many hearsay exceptions.

Templeton v. State involved a felony assault family violence case in which the victim’s father received a butt-dial call from the victim and overheard defendant Templeton make incriminating statements about the assault, which the father then repeated in court. The Templeton court likened butt-dial statements to the requirements of Texas Rules of Evidence 801(e)(2)(A), commonly known as the admission of a party-opponent. Under this rule, a statement is not considered hearsay if it is a statement made by the person whom it is then offered against. In Templeton’s case, that meant that the statements he made on the butt-dial, which were overheard and then repeated by the victim’s father, could be used against him in court where he was the defendant. These statements do not have to be against the interests of the speaker when they are made in order for them to be admissible, rather, the requirement is that the statements be offered as evidence against the speaker/defendant.

Templeton sets the bar rather low in terms of the work it takes to get these kinds of phone calls in. Essentially, any Texas defendant who accidentally butt-dials someone faces the possibility that anything they say—whether they know someone is listening or not, or whether it is against their interest or not—can be repeated in court so long as it is used as evidence against them. The phrase “be careful what you say” could not ring more true. While a majority of butt-dials result in the overhearing of harmless conversations (your comments about who you saw at Trader Joe’s and the gossip you exchange with your friends are not likely to be subjects of court cases), it is important to know that anything you say on those calls has the potential to be repeated in court.

Butt Dials in the Federal System: Do I Have a Reasonable Expectation of Privacy?

Somewhat unsurprisingly, the sentiment that what someone said during a butt-dial can be used against them extends beyond just Texas and into the Federal system as well. In another recent case, Huff v. Spaw, the Sixth Circuit Appeals Court addressed butt-dials in two contexts: the traditional context in which a call is accidentally made and someone on the other end overhears and perhaps even documents or records the calls, and instances in which a butt-dial is made and the listener records the conversation the caller has with a third-party while in a hotel room.

The judge in Huff determined that in the first instance, there is no privacy claim. Essentially, according to the federal courts, it is the duty of every cell phone owner to make sure that their phones are secure. The court points out the commonality of cell phones and their use. There is no expectation of privacy (and therefore no claim) when someone fails to take simple measures to secure their phone and accidentally shares their activities or statements while using an everyday cell phone. As far as precautions go, the biggest one is to lock your phone. From there, there are a number of apps available to help prevent butt-dialing.

As to the second issue, the judge determined that there was a reasonable expectation of privacy, so that part of the case was remanded to the lower court for reconsideration. The key difference between these two issues was the fact that Bertha Huff, with whom James Huff spoke to in her hotel room. Bertha’s part of the conversation, in the judge’s opinion, was protected by a reasonable expectation of privacy because she did not make the butt-dial—as far as she was concerned, all she was doing was speaking to her husband in the comfort of her hotel room.

What Can You do to Protect Your Privacy?

No matter what type of phone you have, the first line of defense in preventing butt-dials and protecting your privacy is to lock your phone. From there, there are a number of other settings you can change that make butt-dialing less likely.

For iPhone users, adding a passcode (or touch/face I.D.) provides an additional layer of protection for users. If you are prone to butt-dialing, you can take it a step further, allowing your phone to auto-lock quickly (Settings –> Display & Brightness –> Auto-Lock). For iPhone users with models that still have the home button, it might be smart to also disable tap-to-wake (Settings –> Accessibility –> Touch –> Tap to Wake).

There are precautions for Android users too! Begin by setting a passcode. To turn off the tap to wake feature on these phones, go to Settings –> Display –> Lock Screen Display –> Double-Tap to Check Phone. To change the time it takes for these phones to auto-lock, go to Settings –> Security –> gear lock icon next to Screen Lock.

If you really want to go above and beyond, there are some apps available for certain phone users to download. If you take all these precautions and still end up in a situation where what you said on a butt-dial is being used against you, consult an attorney to discuss the best plan of action.

No, the Fifth Circuit Court of Appeals recently held that people do not have a reasonable expectation of privacy in the information (1) contained on the Bitcoin blockchain and (2) that you provide to cryptocurrency exchanges.1 The Court reached this decision through an analysis of the facts under the “third party doctrine” of Fourth Amendment jurisprudence. This doctrine is explained in further detail below.

No, the Fifth Circuit Court of Appeals recently held that people do not have a reasonable expectation of privacy in the information (1) contained on the Bitcoin blockchain and (2) that you provide to cryptocurrency exchanges.1 The Court reached this decision through an analysis of the facts under the “third party doctrine” of Fourth Amendment jurisprudence. This doctrine is explained in further detail below.

Prosecutors in Texas must disclose almost all of the evidence in their possession to the defense. Disclosure is the rule and not the exception in Texas.1 Section 39.14(a) of the Texas Code of Criminal Procedure requires the prosecution to disclose anything that “constitutes or contains evidence material to any matter involved in the action. . .”2

Prosecutors in Texas must disclose almost all of the evidence in their possession to the defense. Disclosure is the rule and not the exception in Texas.1 Section 39.14(a) of the Texas Code of Criminal Procedure requires the prosecution to disclose anything that “constitutes or contains evidence material to any matter involved in the action. . .”2

In Texas, the answer is yes. The possession of marijuana is a crime in Texas, so if an officer smells marijuana emanating from your car, he has probable cause to believe a crime is being committed. With probable cause, the law permits the officer to stop and search your car— regardless of whether you consent.

In Texas, the answer is yes. The possession of marijuana is a crime in Texas, so if an officer smells marijuana emanating from your car, he has probable cause to believe a crime is being committed. With probable cause, the law permits the officer to stop and search your car— regardless of whether you consent.

As Fort Worth criminal defense attorneys, we are often asked by witnesses and victims what might happen if it comes to light that the story they told the police was not exactly true. We often see this in

As Fort Worth criminal defense attorneys, we are often asked by witnesses and victims what might happen if it comes to light that the story they told the police was not exactly true. We often see this in

With roadway cameras at nearly every street corner, video surveillance in businesses, doorbell cameras on homes, web cams on computers, and recording capabilities on mobile phones – we must navigate carefully in a digital world. We’ve seen titillating news reports exposing a secret audio tape of a public figure having scandalous phone conversations, or video surveillance of questionable traffic stops that escalate in shocking fashion. You may have had a suspicious feeling that you were being recorded, or on the other hand, felt as if you needed to record a conversation with another for your own protection.

With roadway cameras at nearly every street corner, video surveillance in businesses, doorbell cameras on homes, web cams on computers, and recording capabilities on mobile phones – we must navigate carefully in a digital world. We’ve seen titillating news reports exposing a secret audio tape of a public figure having scandalous phone conversations, or video surveillance of questionable traffic stops that escalate in shocking fashion. You may have had a suspicious feeling that you were being recorded, or on the other hand, felt as if you needed to record a conversation with another for your own protection.

Have you sustained property damage in a powerful storm? If so, you probably had to call a contractor to do necessary repairs. It is sometimes customary in the construction industry for contractors to ask homeowners to pay for some of the work up front, and pay the remaining balance upon completion. Some contractors will ask you to fork over a hefty deposit to someone you do not know, yet you are trusting to get the job done. You are not alone. The good news is that most contractors will operate above the board. Even though social media reviews and ratings sites, such as

Have you sustained property damage in a powerful storm? If so, you probably had to call a contractor to do necessary repairs. It is sometimes customary in the construction industry for contractors to ask homeowners to pay for some of the work up front, and pay the remaining balance upon completion. Some contractors will ask you to fork over a hefty deposit to someone you do not know, yet you are trusting to get the job done. You are not alone. The good news is that most contractors will operate above the board. Even though social media reviews and ratings sites, such as

This was the 5th year for our law firm to offer scholarships. In honor of the sacrifices of our military veterans, we decided to that the scholarships should be connected to military service. The first scholarship is a $500 award for a

This was the 5th year for our law firm to offer scholarships. In honor of the sacrifices of our military veterans, we decided to that the scholarships should be connected to military service. The first scholarship is a $500 award for a

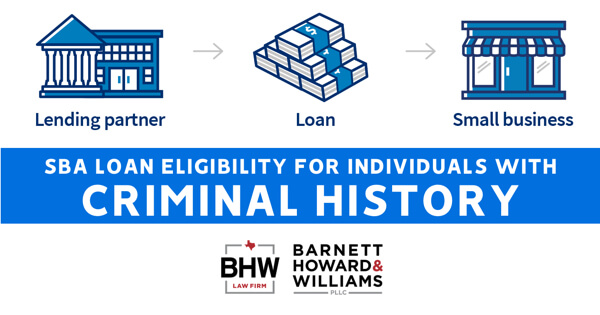

Countless small businesses have been impacted by the

Countless small businesses have been impacted by the

There are some criminal offenses that require the state the prove that the defendant acted “recklessly” or with “criminal recklessness.” In a colloquial sense, we (including prosecutors) often think of recklessness as another word for carelessness, but it actually has a specific definition in the Texas Penal Code.

There are some criminal offenses that require the state the prove that the defendant acted “recklessly” or with “criminal recklessness.” In a colloquial sense, we (including prosecutors) often think of recklessness as another word for carelessness, but it actually has a specific definition in the Texas Penal Code.