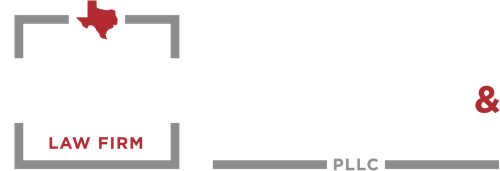

Don’t let a catchy slogan cost you thousands. While ‘Settlement Mill’ firms spend millions on billboards to process volume, true trial lawyers focus on maximizing value in the courtroom.

They promise “Easy Money” and shout from every billboard on I-35. But behind the marketing budget lies a high-volume factory model that insurance companies have learned to exploit. Here is the in-depth reality of why the lawyer you see the most is often the one the insurance company fears the least.

If you live in Dallas-Fort Worth, you cannot escape them. The “Strong Arms.” The “Hammers.” The catchy jingles promising instant checks and aggressive representation.

When you are injured, in pain, and watching medical bills pile up, these advertisements are designed to trigger a psychological response: relief.They promise a fast, easy solution to a complex problem.

But before you dial that 1-800 number, you need to understand the business mechanics behind those ads. You are not just hiring a lawyer; you are entering a business ecosystem known in the legal industry as a “Settlement Mill.”

Hiring a firm based on a billboard is often the single most profitable thing you can do— for the insurance company.

The Economics of the “Settlement Mill”

To understand why these firms often deliver lower results, you have to look at their balance sheet.

Marketing on television and billboards in a major metroplex like DFW costs millions of dollars per month. To cover that massive overhead, these firms require one thing above all else: Volume.

They cannot survive by handling 50 cases a year with extreme care and precision. They need to sign up 500, 1,000, or 2,000 cases a year to pay their advertising bills.

This creates a factory mentality:

- The Intake Floor:When you call, you are rarely speaking to a lawyer. You are speaking to a call center trained to sign you up immediately.

- The Conveyor Belt:Once signed, your case enters a queue. To keep the lights on, the firm needs to move your case from “Open” to “Settled” as fast as possible.

- The Conflict:Taking a case to trial takes time (often 12-18 months or more) and costs money. Settling a case takes 90 days. For a volume firm, a quick settlement of $15,000 is often more profitable for themthan fighting for two years to get you $100,000.

The “Case Manager” Reality

The most common complaint we hear from clients who fire billboard or television commercial firms to hire HLAW is simple: “I never met my attorney.”

In the Settlement Mill model, attorneys are expensive. To maximize profit, these firms assign your case to a “Case Manager” or “Pre-Litigation Specialist.” These are often non-lawyers with no legal degree. Their job is to gather your medical records and process your claim like data entry.

At Howard Lotspeich Alexander & Williams (HLAW), we reject this model. Our partners are former prosecutors and local attorneys with well over a decade of courtroom and trial experience. When you hire us, you get us.We believe that strategic legal decisions should be made by trial lawyers, not administrative staff.

The “Colossus” Factor: How Insurance Companies Profile Your Lawyer

This is the secret the industry tries to keep quiet: Insurance companies use AI and data profiling to value your case.

Major carriers like Allstate, State Farm, and Geico use evaluation software (such as Colossus) to determine how much to offer you. One of the most heavily weighted inputs in that algorithm is the identity of your lawyer.

The insurance industry maintains vast historical data on law firms. They know exactly which firms:

- File lawsuits:(The firms that fight).

- Settle pre-litigation:(The firms that fold).

If you hire a billboard lawyer who settles 99% of their cases without ever filing a lawsuit, the software flags your claim as “Low Risk.” The computer knows there is no threat of a jury verdict, so it spits out a “Lowball” offer range.

Conversely, when an adjuster sees HLAWon the letterhead, the risk profile changes. They see a firm led by serious litigators who are comfortable in a courtroom. To avoid the cost and risk of a trial, the software—and the adjuster—are forced to increase the offer.

The Missing Weapon: The StowersDoctrine

Texas law provides a powerful weapon for injury victims called the StowersDoctrine.

In simple terms, a Stowersdemand forces an insurance company to pay their policy limits now, or risk being on the hook for the entirejury verdict later (even if it exceeds the policy). It is the ultimate pressure tactic.

But a Stowersdemand is a bluff unless you can back it up.

If a Settlement Mill sends a Stowersdemand, the insurance company often laughs it off. They know that firm has no intention of going to trial. They know that if they say “no,” the billboard lawyer will likely just convince the client to take the lower amount.

At HLAW, our Stowersdemands have teeth. We prepare every case as if it is going to trial. We take depositions. We hire experts. We build the pressure until the insurance company realizes that paying you fairly is their only safe option.

The “Litigation Gap”

Here is a scenario that happens every day in Fort Worth: A client hires a TV lawyer. The insurance company denies liability or makes a tiny offer. Because the TV lawyer relies on “easy” settlements, they don’t want to do the hard work of filing a lawsuit.

So, they drop the client. They send a letter saying, “We can no longer represent you.”

Now, the client has lost months of time and has to start over. At HLAW, we are Battle-Tested Trial Lawyers. We don’t cherry-pick only the easy cases. If the insurance company refuses to be fair, we don’t drop you—we sue them.

Don’t Be a Statistic. Be a Priority.

Marketing is not the same as legal ability. A catchy jingle doesn’t scare a billion-dollar insurance corporation. A billboard doesn’t win a cross-examination.

Your injury settlement is likely the only compensation you will ever receive for your pain, your surgery, and your lost future wages. Do not entrust that financial lifeline to a firm that views you as a unit of inventory.

Choose the firm that insurance companies respect—and take seriously.

Contact HLAWtoday for a free consultation and case evaluation. We don’t need billboards to tell you who we are. We let our results in the courtroom do the talking.

Although a horse can transport people on a public highway, it is not a device in the mechanical sense. For this reason, courts and prosecutors in Texas should not treat intoxicated horseback riding as a DWI offense.

Although a horse can transport people on a public highway, it is not a device in the mechanical sense. For this reason, courts and prosecutors in Texas should not treat intoxicated horseback riding as a DWI offense.